Cashing Out Retirement Before 59 1/2

When life throws unexpected challenges your way, it can feel natural to turn to your retirement accounts for quick cash. But before you withdraw funds, it’s important to understand the tax consequences of cashing out retirement before 59 ½. At Gundersons CFO & Bookkeeping, we’ve seen how this decision can create painful surprises. Recently, two […]

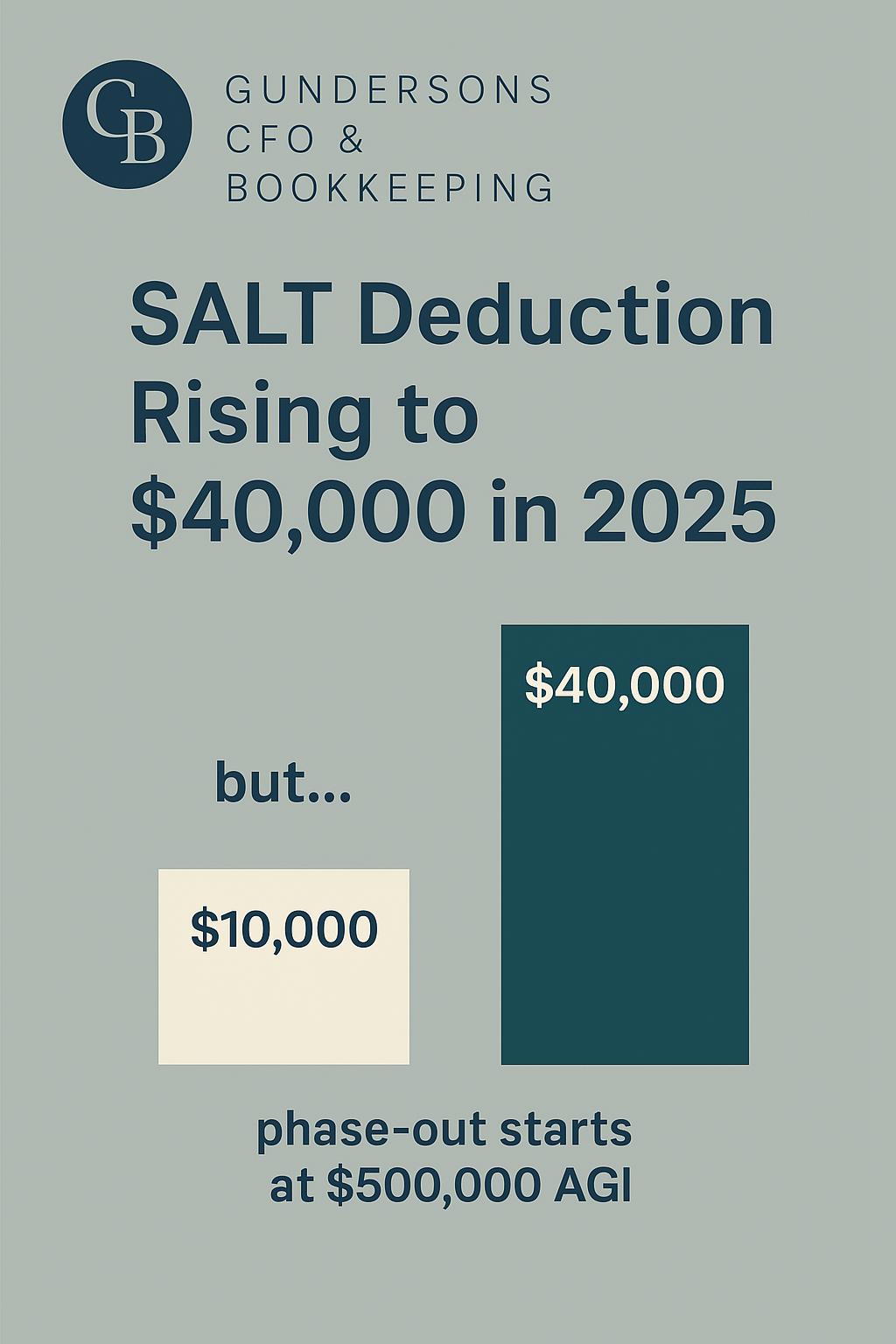

Big Changes Ahead: SALT Deduction Rising in 2025

Big Changes Ahead: SALT Deduction Rising to $40,000 in 2025 Did you know the SALT (State and Local Tax) deduction is getting a major increase starting in 2025? For many taxpayers, this is a big deal. Let’s break it down. A Quick Look Back In 2018, the Tax Cuts and Jobs Act nearly doubled the […]

Depreciation Isn’t Always the Best Move for Your Business

Why Taking More Depreciation Isn’t Always the Best Move for Your Business When it comes to tax planning, depreciation is one of the most powerful tools business owners have. In my last two posts, I talked about bonus depreciation vs. Section 179. Both strategies let you deduct the cost of fixed assets more quickly, reducing […]

W-9s and 1099s- Changes in 2025

💥 Big Beautiful Tax Bill – W-9s & 1099s: Everything You Need to Know 💥 If you work with contractors, freelancers, or vendors in your business, W-9s and 1099s are more than just paperwork — they’re an IRS requirement. And in 2025, the Big Beautiful Tax Bill brings important changes you need to know about. […]

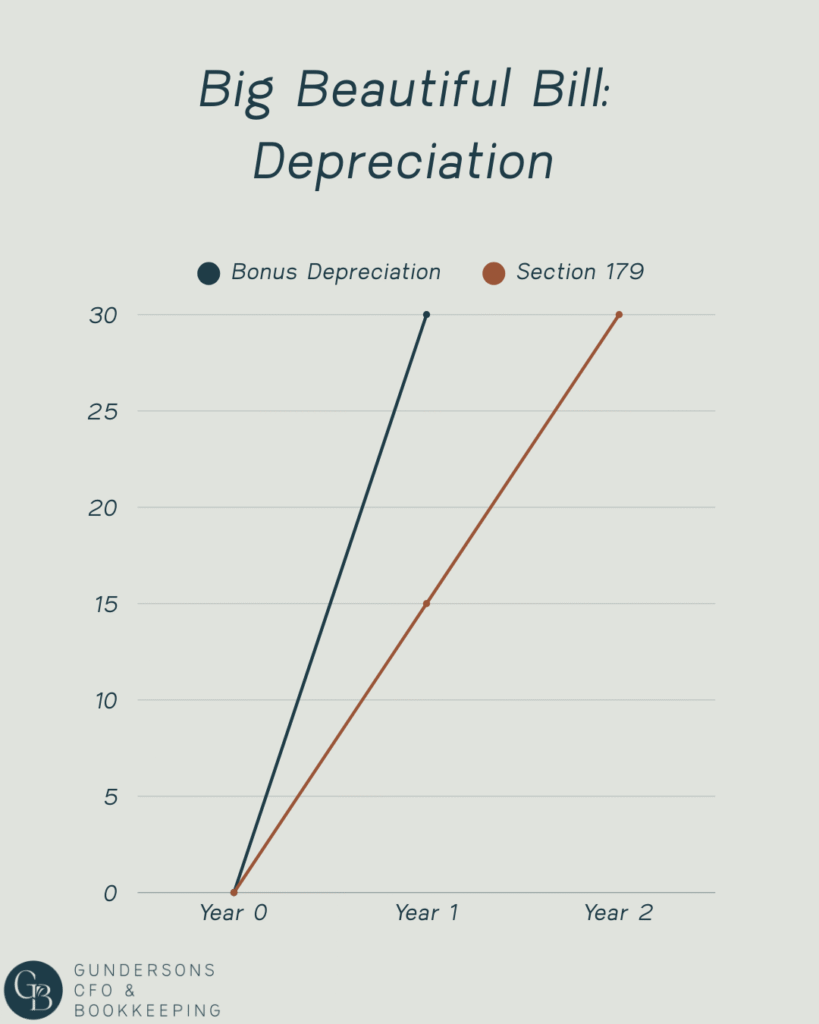

Section 179 & Bonus Depreciation

💥 Big Beautiful Tax Bill – Part 6 💥 When you purchase qualifying business assets, you often have the chance to deduct the entire cost in the year you start using them. The two main ways to do this — Bonus Depreciation and Section 179 — both get you there, but in very different ways. […]

100% Bonus Depreciation Explained

It’s back—and it’s permanent!100% Bonus Depreciation has officially returned for small business owners, giving you a powerful opportunity to write off qualifying purchases in full the year you place them in service. In Part 5 of our Big Beautiful Tax Bill video series, we break down everything you need to know about this powerful deduction […]