W-9s and 1099s- Changes in 2025

💥 Big Beautiful Tax Bill – W-9s & 1099s: Everything You Need to Know 💥 If you work with contractors, freelancers, or vendors in your business, W-9s and 1099s are more than just paperwork — they’re an IRS requirement. And in 2025, the Big Beautiful Tax Bill brings important changes you need to know about. […]

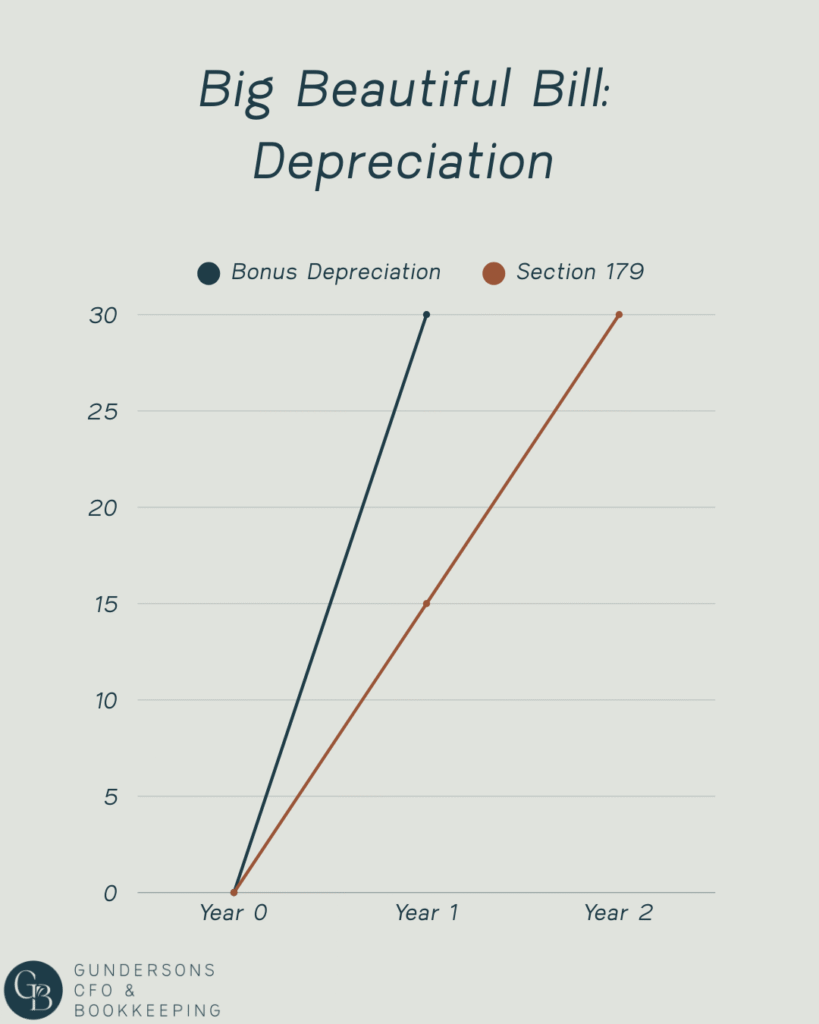

Section 179 & Bonus Depreciation

💥 Big Beautiful Tax Bill – Part 6 💥 When you purchase qualifying business assets, you often have the chance to deduct the entire cost in the year you start using them. The two main ways to do this — Bonus Depreciation and Section 179 — both get you there, but in very different ways. […]

100% Bonus Depreciation Explained

It’s back—and it’s permanent!100% Bonus Depreciation has officially returned for small business owners, giving you a powerful opportunity to write off qualifying purchases in full the year you place them in service. In Part 5 of our Big Beautiful Tax Bill video series, we break down everything you need to know about this powerful deduction […]

📊 Big Beautiful Tax Bill: Part 1

The Big Beautiful Tax Bill is making waves — and if you’re a small business owner, self-employed, or even a high-earning W-2 employee, the changes coming in 2025 could directly impact how much tax you owe (or save). In this first video of our new tax series, we’re digging into two major updates:✅ New tax […]