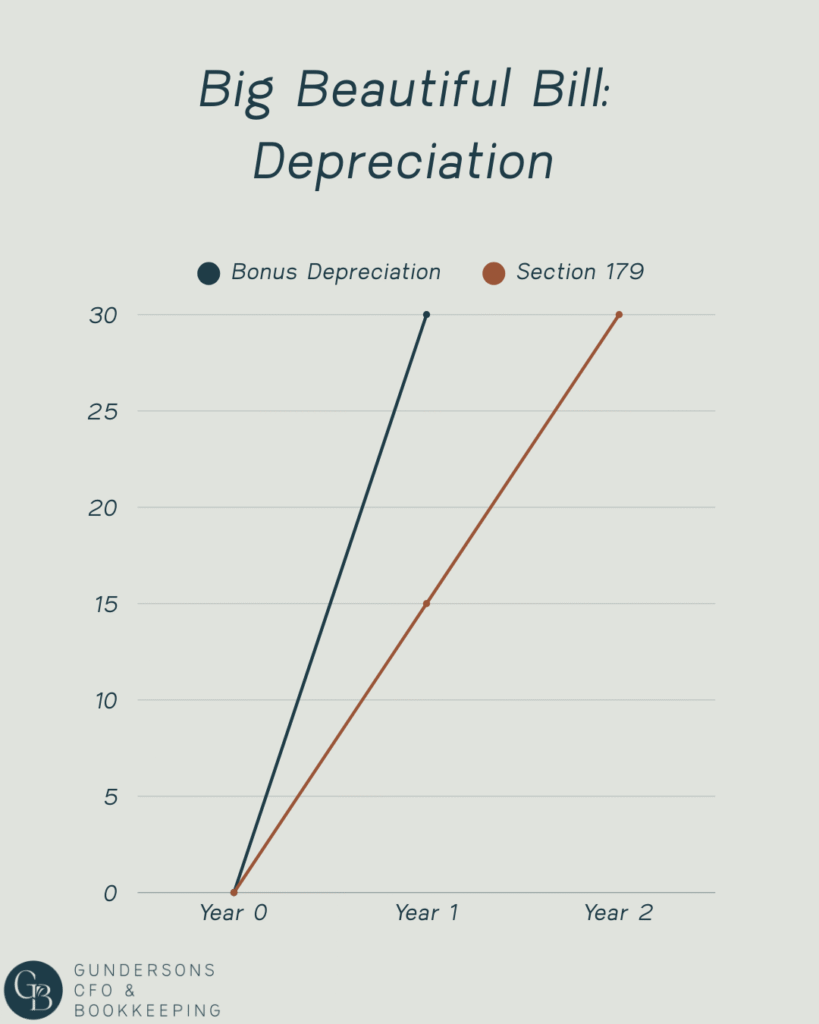

Section 179 & Bonus Depreciation

💥 Big Beautiful Tax Bill – Part 6 💥 When you purchase qualifying business assets, you often have the chance to deduct the entire cost in the year you start using them. The two main ways to do this — Bonus Depreciation and Section 179 — both get you there, but in very different ways. […]

100% Bonus Depreciation Explained

It’s back—and it’s permanent!100% Bonus Depreciation has officially returned for small business owners, giving you a powerful opportunity to write off qualifying purchases in full the year you place them in service. In Part 5 of our Big Beautiful Tax Bill video series, we break down everything you need to know about this powerful deduction […]