New Texas Tax Amendment: What Happens If Your Home Burns Down

Texas Passed Proposition 10: What It Means If Your Home Is Destroyed by Fire Homeowners across Texas recently gained a powerful new protection, and most people don’t even know it exists. As part of the constitutional amendments that passed this year, Proposition 10 introduced a major change to property taxes — especially in situations involving […]

No Tax on Tips: What You Need to Know About This New 2025–2028 Rule

If you earn tips as part of your regular income, there’s a new tax rule coming that could make a real difference in your take-home pay. Beginning in 2025, qualifying workers in industries where tips are regular and customary may be able to exclude up to $25,000 in tips from taxable income each year. This […]

Shareholder Loans: Protecting Your Business and Personal Assets

Many small business owners loan money to their business at some point — whether it’s to cover startup costs, manage cash flow, or fund growth. But here’s the problem: most don’t realize that failing to properly document these loans can put both their business and personal assets at risk. If the IRS ever reviews your […]

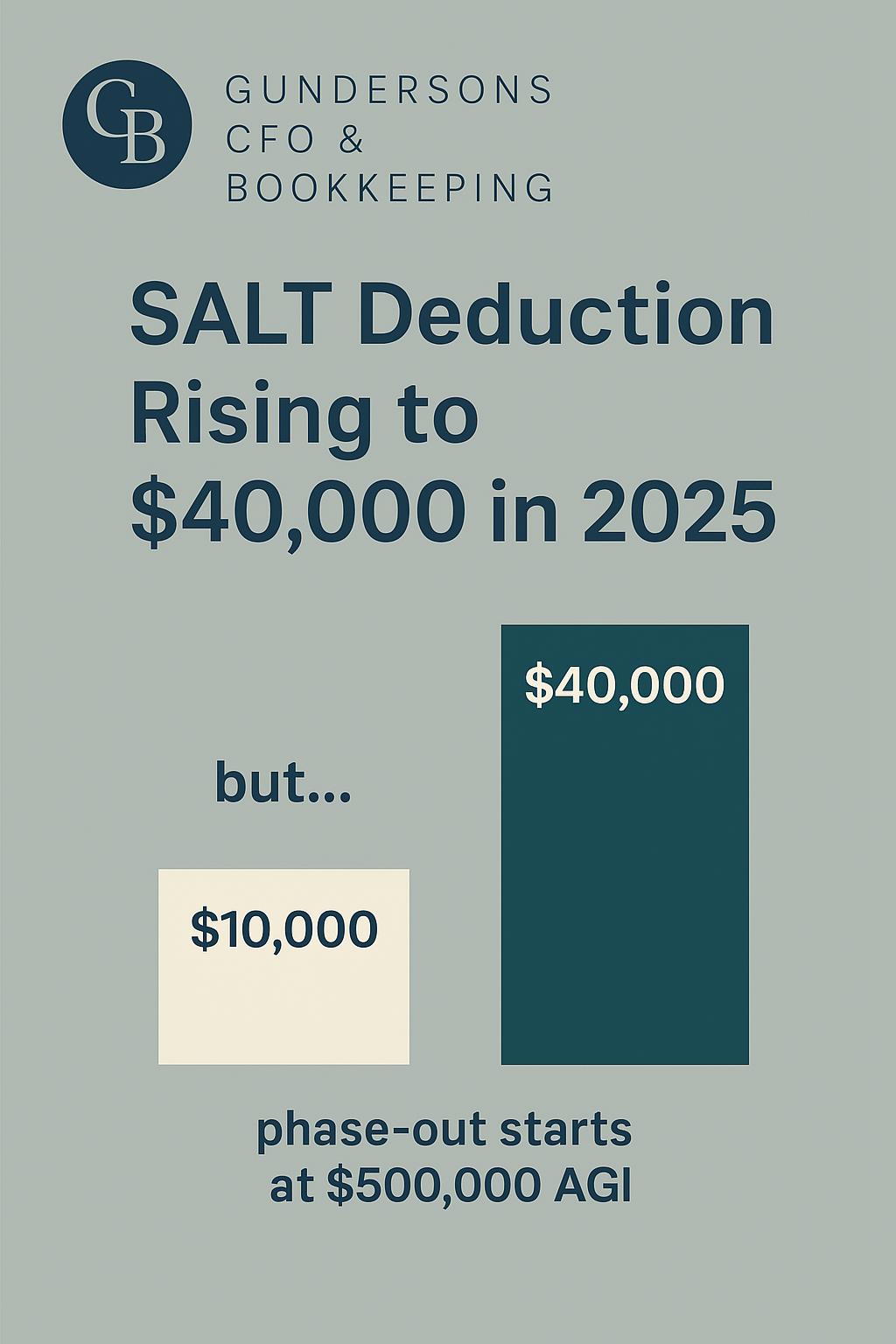

Big Changes Ahead: SALT Deduction Rising in 2025

Big Changes Ahead: SALT Deduction Rising to $40,000 in 2025 Did you know the SALT (State and Local Tax) deduction is getting a major increase starting in 2025? For many taxpayers, this is a big deal. Let’s break it down. A Quick Look Back In 2018, the Tax Cuts and Jobs Act nearly doubled the […]

Depreciation Isn’t Always the Best Move for Your Business

Why Taking More Depreciation Isn’t Always the Best Move for Your Business When it comes to tax planning, depreciation is one of the most powerful tools business owners have. In my last two posts, I talked about bonus depreciation vs. Section 179. Both strategies let you deduct the cost of fixed assets more quickly, reducing […]

💸 Tax Implications of Withdrawing $100K from 401k

retirement withdrawal strategy