New Texas Tax Amendment: What Happens If Your Home Burns Down

Texas Passed Proposition 10: What It Means If Your Home Is Destroyed by Fire Homeowners across Texas recently gained a powerful new protection, and most people don’t even know it exists. As part of the constitutional amendments that passed this year, Proposition 10 introduced a major change to property taxes — especially in situations involving […]

Texas Passed 17 Constitutional Amendments — Here’s What Homeowners & Business Owners Need to Know

Texas voters just approved 17 new amendments to the state constitution, and several of them directly impact property taxes, small businesses, veterans, long-term planning, and everyday Texans. These are not minor updates.These changes reshape parts of how Texas taxes property, supports certain groups, and funds statewide initiatives. If you’re a homeowner, investor, or business owner, […]

The New $6,000 Senior Deduction: What You Need to Know (Big Beautiful Tax Bill – Part 15)

A New Tax Break for Seniors If you’re 65 or older, the Big Beautiful Tax Bill just delivered some great news — a brand-new $6,000 senior deduction per person beginning in 2025. What makes this exciting is that it applies to both itemizers and non-itemizers, meaning you can take advantage of it even if you […]

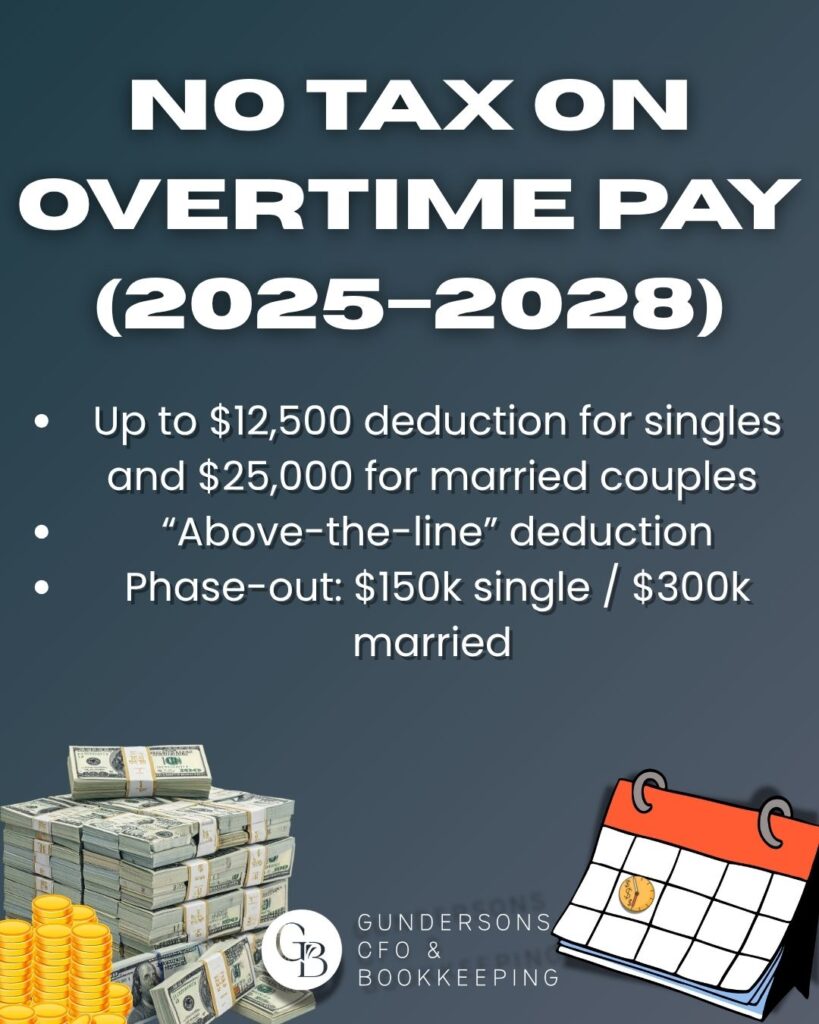

No Tax on Overtime Pay? Here’s What You Need to Know (2025–2028)

A New Temporary Break for Overtime Workers If you’ve ever worked extra hours to get ahead, there’s a brand-new reason to smile. Beginning in 2025, the Big Beautiful Tax Bill introduces a temporary tax break that makes overtime pay tax-free—up to a point. This new rule runs from 2025 through 2028 and allows qualifying taxpayers […]

No Tax on Tips: What You Need to Know About This New 2025–2028 Rule

If you earn tips as part of your regular income, there’s a new tax rule coming that could make a real difference in your take-home pay. Beginning in 2025, qualifying workers in industries where tips are regular and customary may be able to exclude up to $25,000 in tips from taxable income each year. This […]

Failure Isn’t the Opposite of Success — It’s the Path to It

As entrepreneurs, we should fail every single day, but we often chase perfection. We want every launch, hire, and idea to be flawless. But here’s the truth — success doesn’t come from avoiding failure; it comes from embracing it. When you fail, you learn. And when you learn faster than everyone else, you grow faster, […]