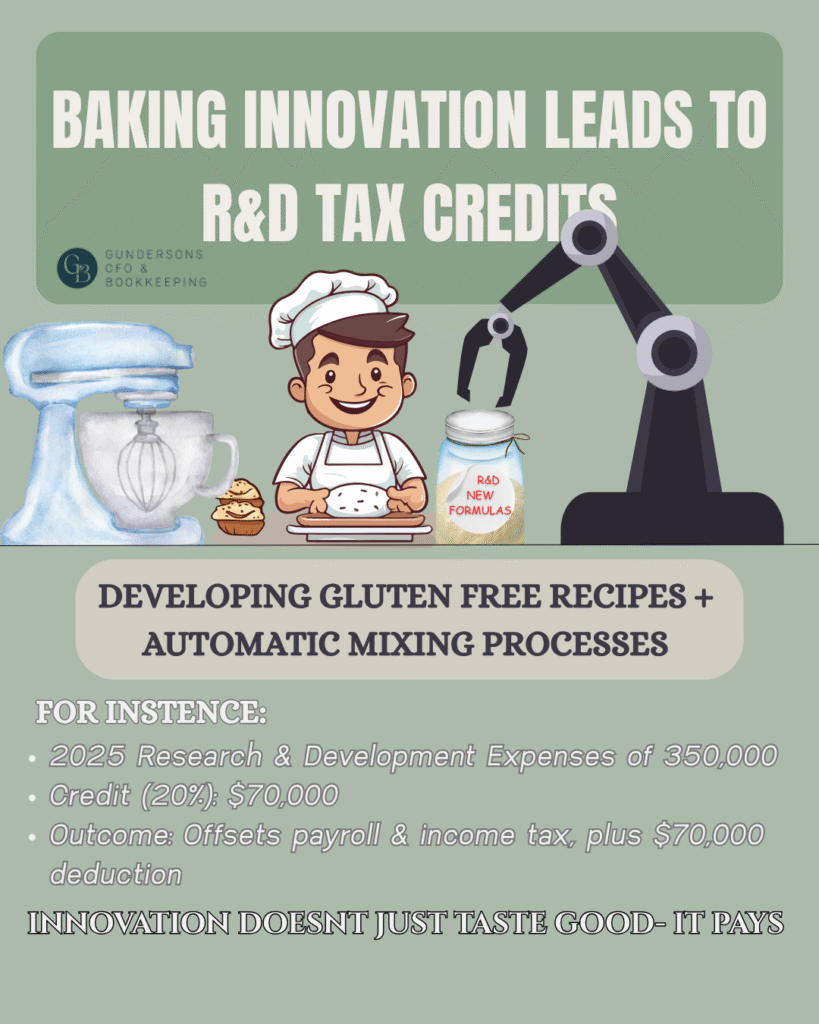

R&D Tax Credits: Not Just for Dudes in White Lab Coats

When you hear “Research & Development,” what comes to mind?If you’re picturing scientists in lab coats, bubbling beakers, and million-dollar labs — you’re not alone. But here’s the truth: the R&D Tax Credit applies to far more businesses than most realize.From steel mills and software companies to bakeries and breweries, innovation looks different in every […]

Qualified Opportunity Zone Fund: How to Maximize Tax Benefits

Many investors assume that buying property in an Opportunity Zone (OZ) automatically provides a tax break. Unfortunately, that’s not the case. To benefit from OZ incentives, you must invest through a Qualified Opportunity Zone Fund using capital gains. Let’s break down the rules and the real tax benefits. Why You Need a Qualified Opportunity Zone […]

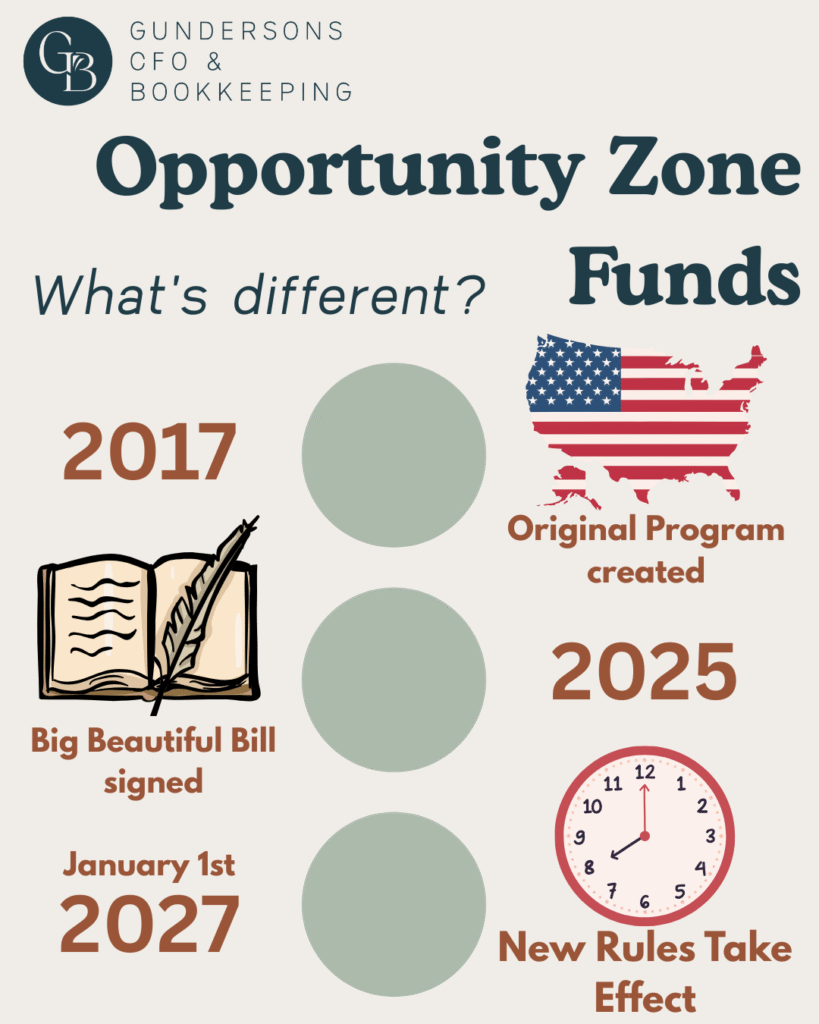

How the One Big Beautiful Bill Is Changing Opportunity Zone Funds

Opportunity Zone Funds have been one of the most powerful tools for investors since they were created under the 2017 Tax Cuts and Jobs Act. They allow you to defer capital gains, potentially eliminate taxes on new growth, and at the same time, invest in communities that need it most. But as with most tax […]

Shareholder Loans: Protecting Your Business and Personal Assets

Many small business owners loan money to their business at some point — whether it’s to cover startup costs, manage cash flow, or fund growth. But here’s the problem: most don’t realize that failing to properly document these loans can put both their business and personal assets at risk. If the IRS ever reviews your […]

Laid off? What to Do with Your 401(k)

Getting laid off is one of the most stressful situations anyone can face. Beyond the immediate concerns of finding new work and managing day-to-day expenses, there’s often a big financial question hanging over your head: What should you do with your 401(k)? For many, a retirement account is one of their largest assets. Unfortunately, it’s […]

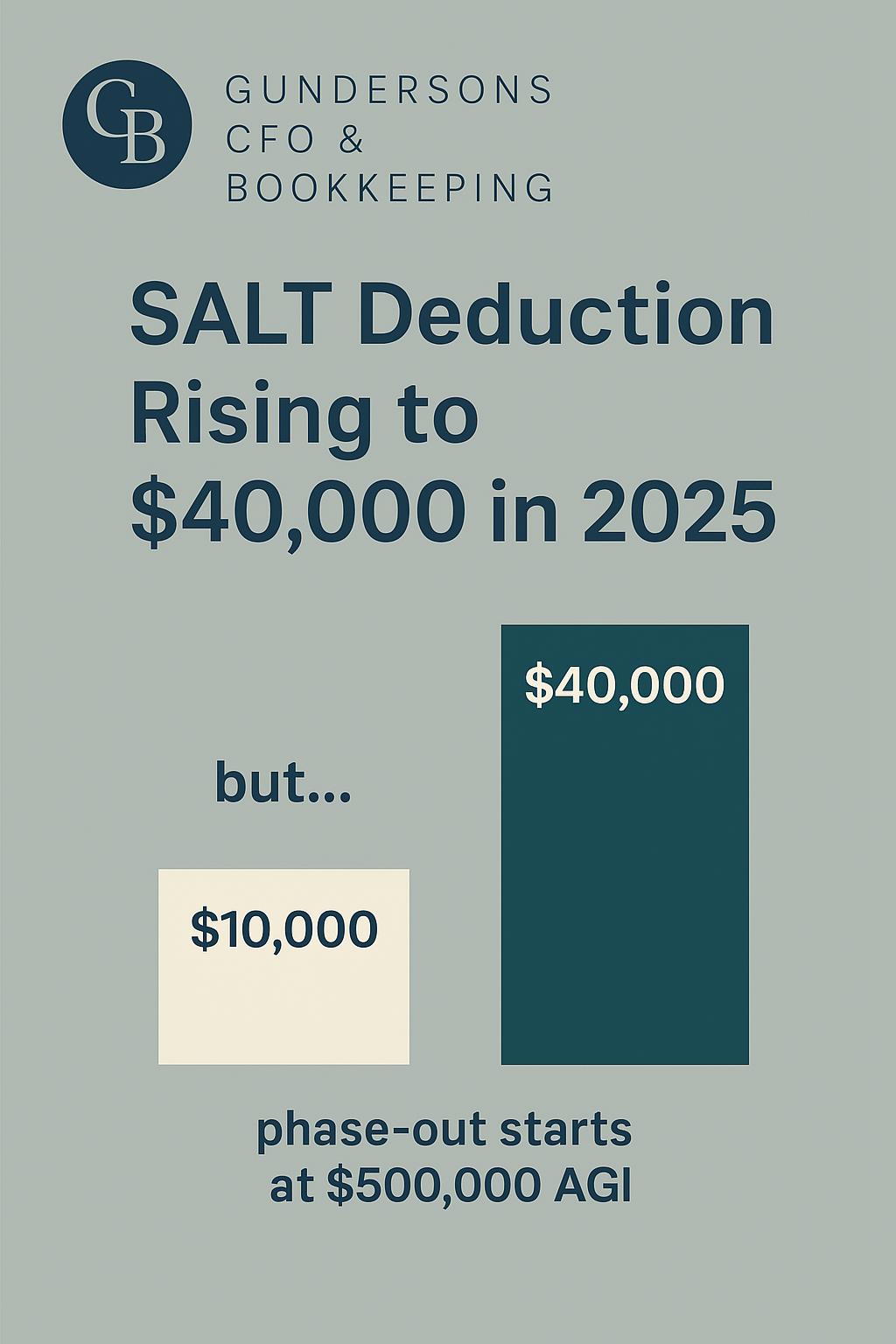

Big Changes Ahead: SALT Deduction Rising in 2025

Big Changes Ahead: SALT Deduction Rising to $40,000 in 2025 Did you know the SALT (State and Local Tax) deduction is getting a major increase starting in 2025? For many taxpayers, this is a big deal. Let’s break it down. A Quick Look Back In 2018, the Tax Cuts and Jobs Act nearly doubled the […]