Depreciation Isn’t Always the Best Move for Your Business

Why Taking More Depreciation Isn’t Always the Best Move for Your Business When it comes to tax planning, depreciation is one of the most powerful tools business owners have. In my last two posts, I talked about bonus depreciation vs. Section 179. Both strategies let you deduct the cost of fixed assets more quickly, reducing […]

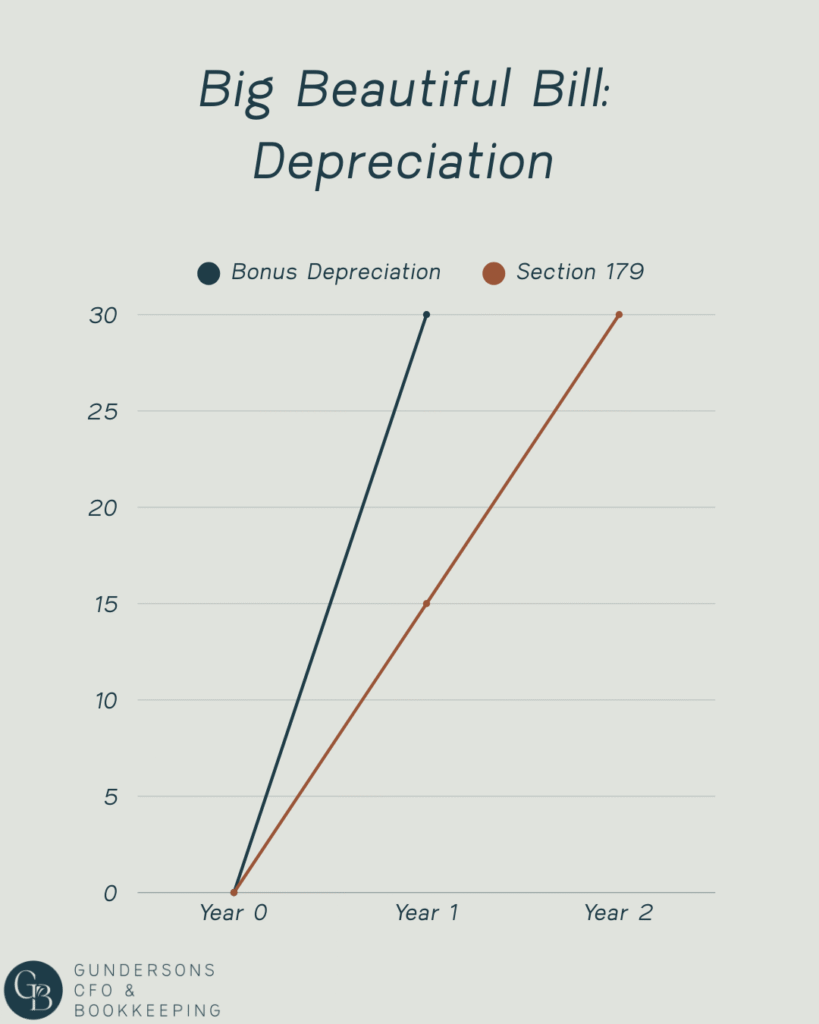

Section 179 & Bonus Depreciation

💥 Big Beautiful Tax Bill – Part 6 💥 When you purchase qualifying business assets, you often have the chance to deduct the entire cost in the year you start using them. The two main ways to do this — Bonus Depreciation and Section 179 — both get you there, but in very different ways. […]

💸 Tax Implications of Withdrawing $100K from 401k

retirement withdrawal strategy

Family Office for Small Business Owners: Turn Your Business into a Wealth-Building Machine

When most people hear the term “Family Office,” they immediately think of ultra-wealthy families managing When you hear “family office,” you might think of billionaires managing private jets, real estate, and trusts—but you don’t need to be ultra-wealthy to benefit from one. In fact, a Family Office for small business owners is one of the […]

Annuities 101: How They Work & If They’re Right for You!

When people hear the word annuity, it often triggers a strong reaction—and not always a positive one. But like many financial tools, annuities have evolved. And if you’ve been hearing mixed messages about whether annuities are a smart move for your retirement, you’re not alone. I recently sat down with financial strategist Pete Catalano to […]

8 Year-End Tax Planning Strategies

As the year wraps up, small business owners have a golden opportunity to take action and reduce their tax burden for 2024. Planning ahead can mean the difference between overpaying on taxes or maximizing deductions to keep more money in your pocket. Here are 8 essential tax planning strategies to implement before the year ends: […]