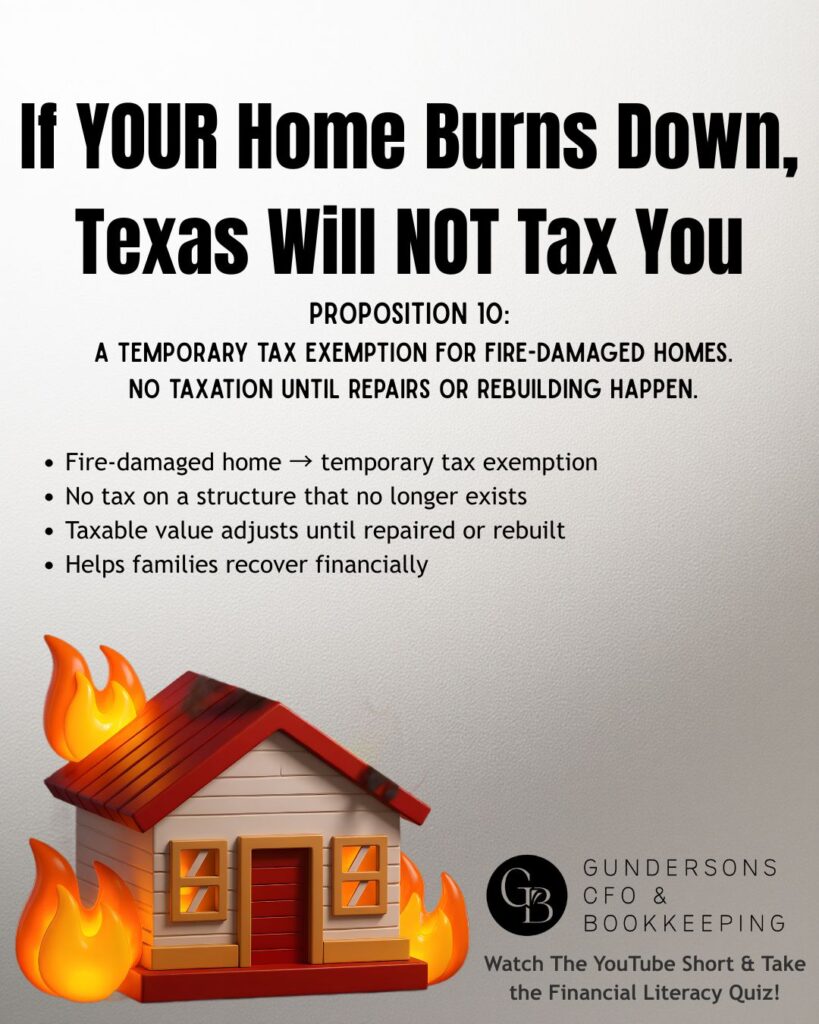

New Texas Tax Amendment: What Happens If Your Home Burns Down

Texas Passed Proposition 10: What It Means If Your Home Is Destroyed by Fire Homeowners across Texas recently gained a powerful new protection, and most people don’t even know it exists. As part of the constitutional amendments that passed this year, Proposition 10 introduced a major change to property taxes — especially in situations involving […]

Texas Passed 17 Constitutional Amendments — Here’s What Homeowners & Business Owners Need to Know

Texas voters just approved 17 new amendments to the state constitution, and several of them directly impact property taxes, small businesses, veterans, long-term planning, and everyday Texans. These are not minor updates.These changes reshape parts of how Texas taxes property, supports certain groups, and funds statewide initiatives. If you’re a homeowner, investor, or business owner, […]

The New $6,000 Senior Deduction: What You Need to Know (Big Beautiful Tax Bill – Part 15)

A New Tax Break for Seniors If you’re 65 or older, the Big Beautiful Tax Bill just delivered some great news — a brand-new $6,000 senior deduction per person beginning in 2025. What makes this exciting is that it applies to both itemizers and non-itemizers, meaning you can take advantage of it even if you […]

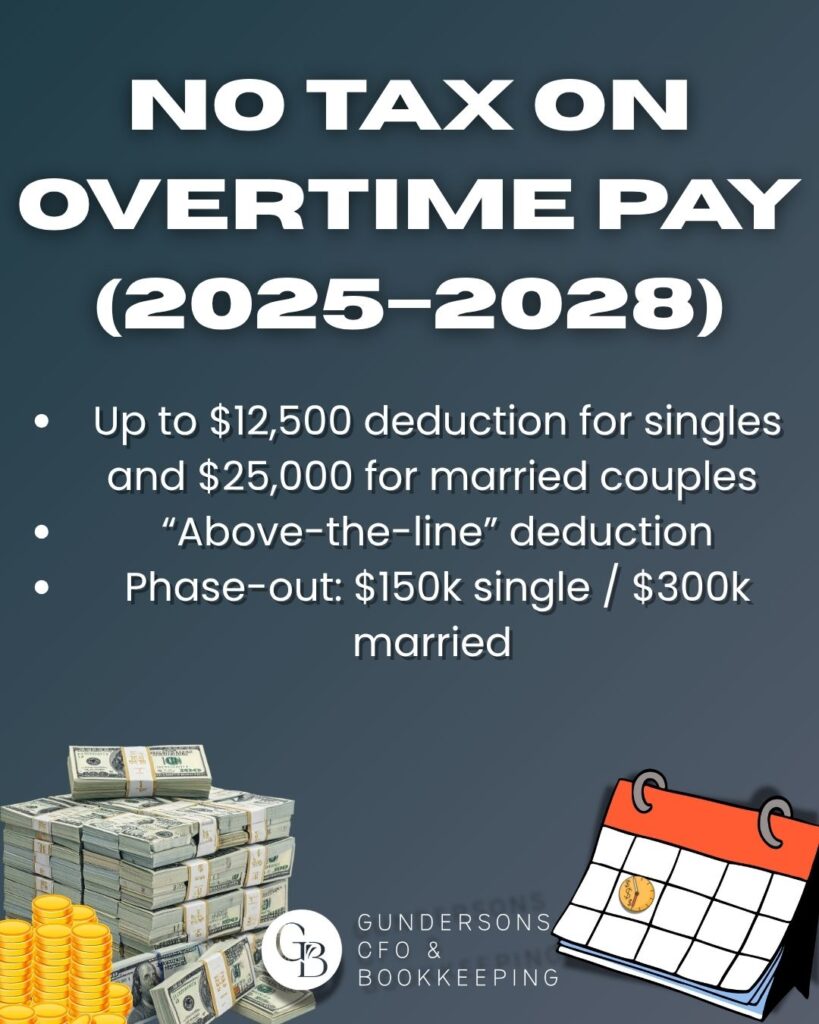

No Tax on Overtime Pay? Here’s What You Need to Know (2025–2028)

A New Temporary Break for Overtime Workers If you’ve ever worked extra hours to get ahead, there’s a brand-new reason to smile. Beginning in 2025, the Big Beautiful Tax Bill introduces a temporary tax break that makes overtime pay tax-free—up to a point. This new rule runs from 2025 through 2028 and allows qualifying taxpayers […]

No Tax on Tips: What You Need to Know About This New 2025–2028 Rule

If you earn tips as part of your regular income, there’s a new tax rule coming that could make a real difference in your take-home pay. Beginning in 2025, qualifying workers in industries where tips are regular and customary may be able to exclude up to $25,000 in tips from taxable income each year. This […]

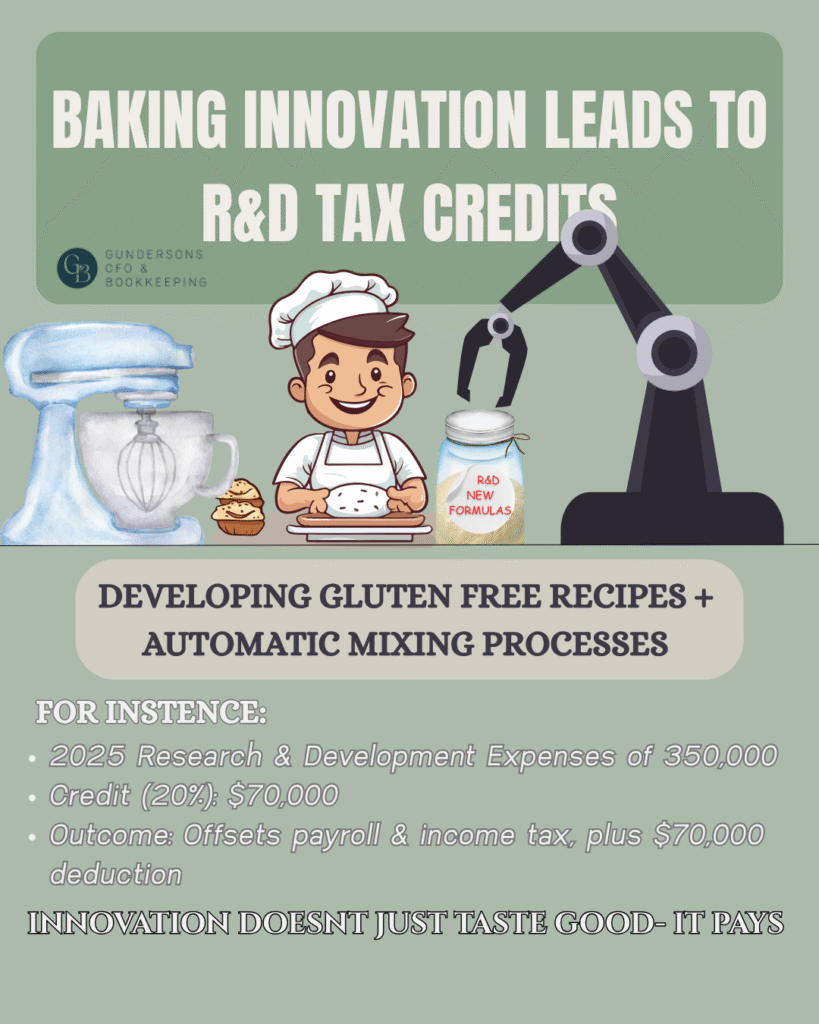

R&D Tax Credits: Not Just for Dudes in White Lab Coats

When you hear “Research & Development,” what comes to mind?If you’re picturing scientists in lab coats, bubbling beakers, and million-dollar labs — you’re not alone. But here’s the truth: the R&D Tax Credit applies to far more businesses than most realize.From steel mills and software companies to bakeries and breweries, innovation looks different in every […]