Shareholder Loans: Protecting Your Business and Personal Assets

Many small business owners loan money to their business at some point — whether it’s to cover startup costs, manage cash flow, or fund growth. But here’s the problem: most don’t realize that failing to properly document these loans can put both their business and personal assets at risk. If the IRS ever reviews your […]

Laid off? What to Do with Your 401(k)

Getting laid off is one of the most stressful situations anyone can face. Beyond the immediate concerns of finding new work and managing day-to-day expenses, there’s often a big financial question hanging over your head: What should you do with your 401(k)? For many, a retirement account is one of their largest assets. Unfortunately, it’s […]

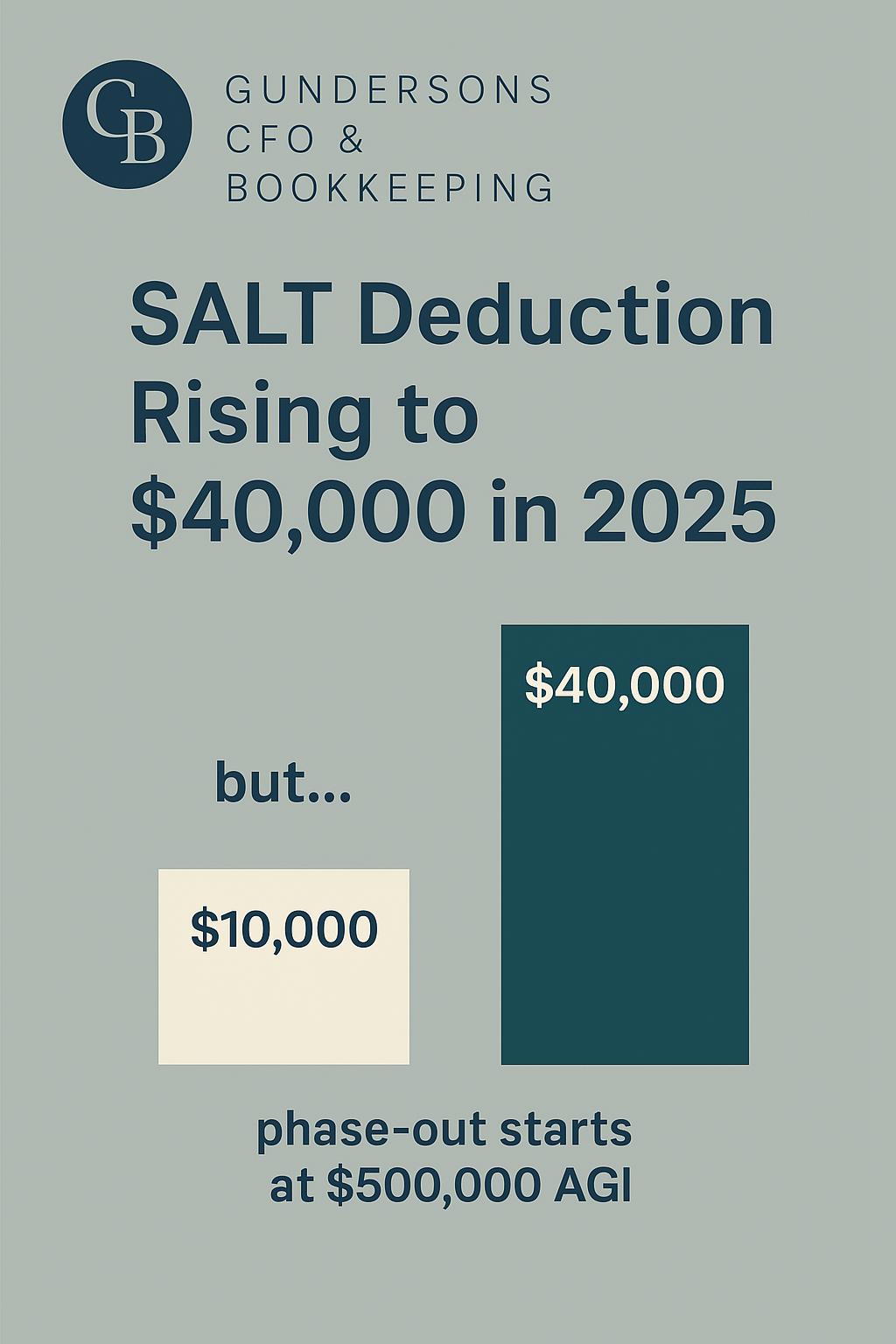

Big Changes Ahead: SALT Deduction Rising in 2025

Big Changes Ahead: SALT Deduction Rising to $40,000 in 2025 Did you know the SALT (State and Local Tax) deduction is getting a major increase starting in 2025? For many taxpayers, this is a big deal. Let’s break it down. A Quick Look Back In 2018, the Tax Cuts and Jobs Act nearly doubled the […]

💸 Tax Implications of Withdrawing $100K from 401k

retirement withdrawal strategy

Annuities 101: How They Work & If They’re Right for You!

When people hear the word annuity, it often triggers a strong reaction—and not always a positive one. But like many financial tools, annuities have evolved. And if you’ve been hearing mixed messages about whether annuities are a smart move for your retirement, you’re not alone. I recently sat down with financial strategist Pete Catalano to […]

8 Year-End Tax Planning Strategies

As the year wraps up, small business owners have a golden opportunity to take action and reduce their tax burden for 2024. Planning ahead can mean the difference between overpaying on taxes or maximizing deductions to keep more money in your pocket. Here are 8 essential tax planning strategies to implement before the year ends: […]