The New $6,000 Senior Deduction: What You Need to Know (Big Beautiful Tax Bill – Part 15)

A New Tax Break for Seniors If you’re 65 or older, the Big Beautiful Tax Bill just delivered some great news — a brand-new $6,000 senior deduction per person beginning in 2025. What makes this exciting is that it applies to both itemizers and non-itemizers, meaning you can take advantage of it even if you […]

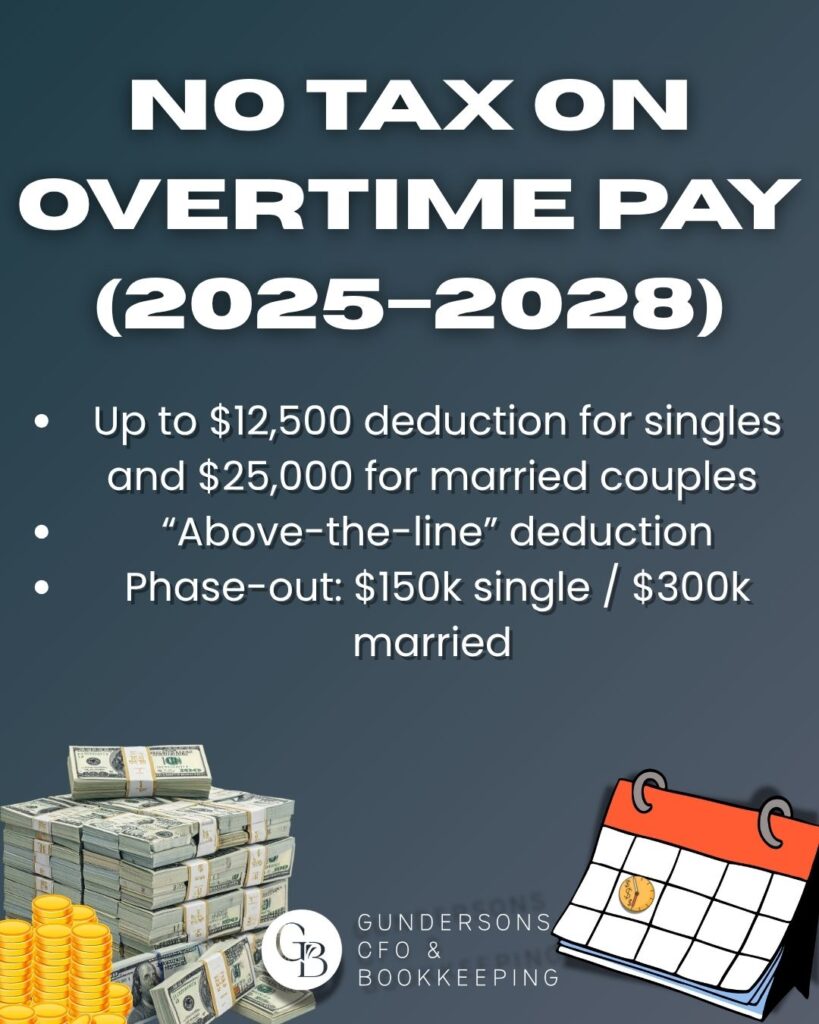

No Tax on Overtime Pay? Here’s What You Need to Know (2025–2028)

A New Temporary Break for Overtime Workers If you’ve ever worked extra hours to get ahead, there’s a brand-new reason to smile. Beginning in 2025, the Big Beautiful Tax Bill introduces a temporary tax break that makes overtime pay tax-free—up to a point. This new rule runs from 2025 through 2028 and allows qualifying taxpayers […]

No Tax on Tips: What You Need to Know About This New 2025–2028 Rule

If you earn tips as part of your regular income, there’s a new tax rule coming that could make a real difference in your take-home pay. Beginning in 2025, qualifying workers in industries where tips are regular and customary may be able to exclude up to $25,000 in tips from taxable income each year. This […]

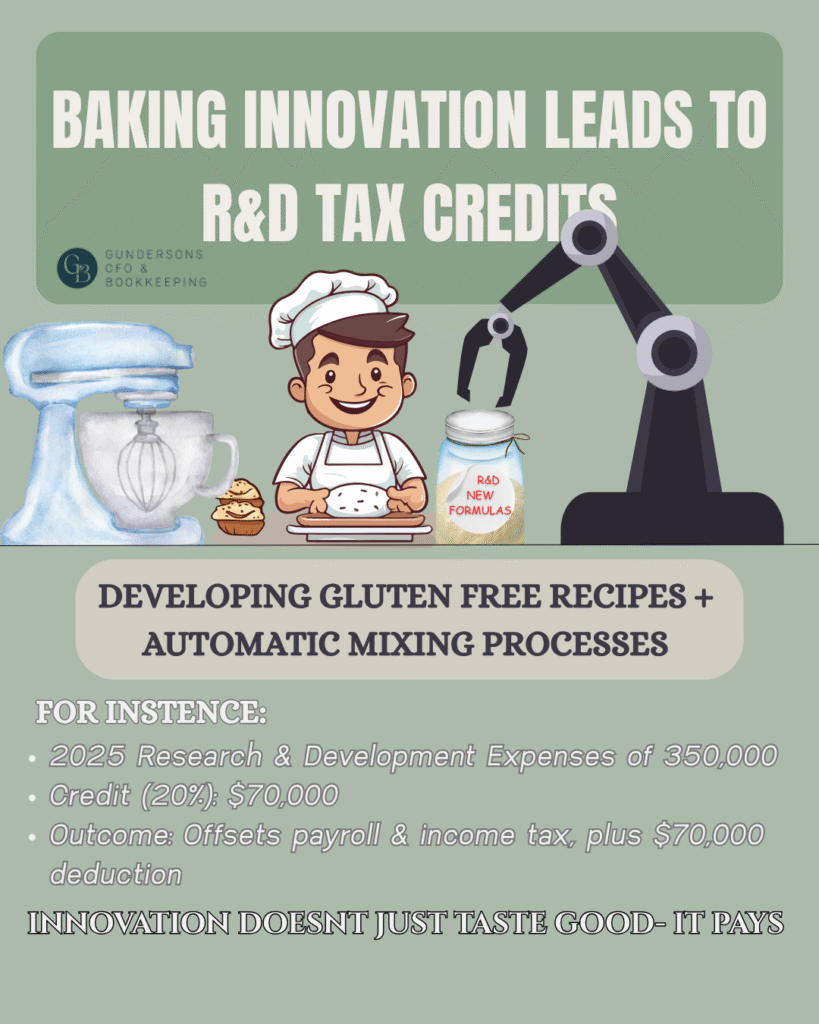

R&D Tax Credits: Not Just for Dudes in White Lab Coats

When you hear “Research & Development,” what comes to mind?If you’re picturing scientists in lab coats, bubbling beakers, and million-dollar labs — you’re not alone. But here’s the truth: the R&D Tax Credit applies to far more businesses than most realize.From steel mills and software companies to bakeries and breweries, innovation looks different in every […]

Qualified Opportunity Zone Fund: How to Maximize Tax Benefits

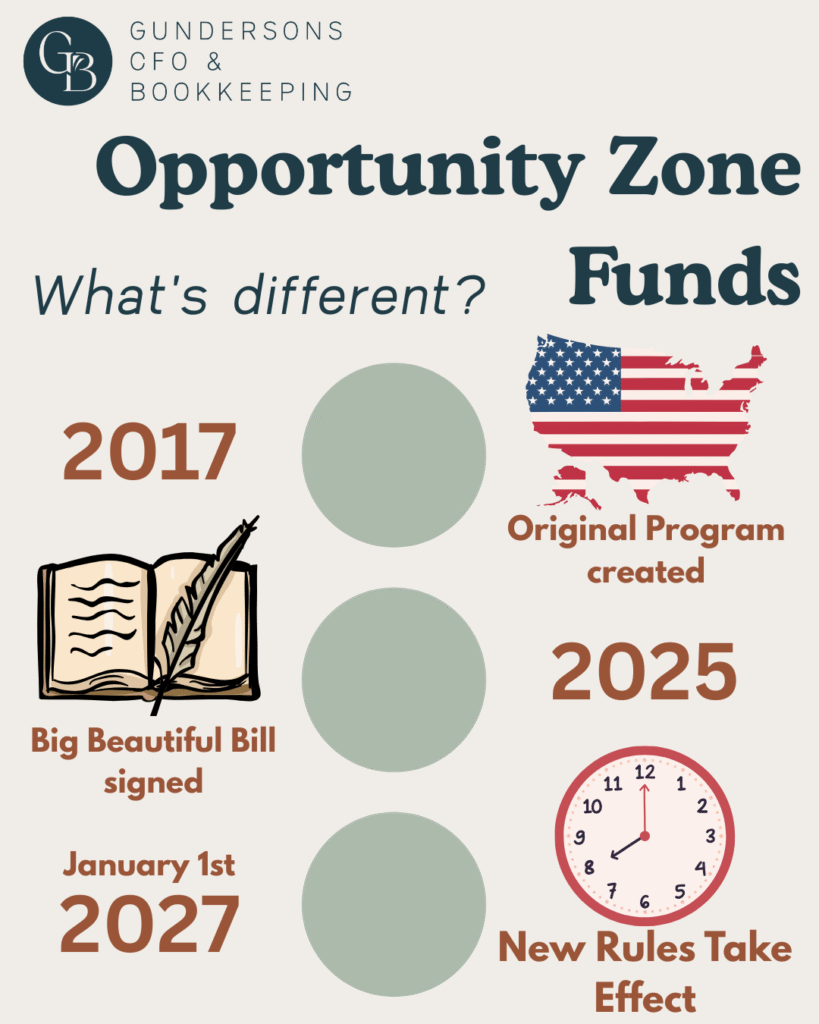

Many investors assume that buying property in an Opportunity Zone (OZ) automatically provides a tax break. Unfortunately, that’s not the case. To benefit from OZ incentives, you must invest through a Qualified Opportunity Zone Fund using capital gains. Let’s break down the rules and the real tax benefits. Why You Need a Qualified Opportunity Zone […]

How the One Big Beautiful Bill Is Changing Opportunity Zone Funds

Opportunity Zone Funds have been one of the most powerful tools for investors since they were created under the 2017 Tax Cuts and Jobs Act. They allow you to defer capital gains, potentially eliminate taxes on new growth, and at the same time, invest in communities that need it most. But as with most tax […]